Unlock Tomorrow

Esusu Stories

As we close the chapter on 2024, we find ourselves reflecting on a year that has been as challenging as it has been transformative. In the face of one of the most difficult housing markets in history, our commitment to tackling credit inequity and unlocking opportunity for millions of renters has never wavered. We remain incredibly optimistic about the possibilities 2025 will bring.

.png)

Unlocking Unprecendented Economic Activity

Esusu renters have now accessed over $46.9B in new credit tradelines

$29B+

Mortgages

$8.6B+

Auto Loans

$2.1B+

Student Loans

$7.1B+

Credit Cards

Unlocking Housing Stability

Rent Relief

“I recently found out I was a high risk pregnancy, and had to leave my job. I didn't know how I would pay my rent. I went into my apartment office, and found a brochure about rental relief. I signed up within 20 I received an email about thing I had to show proof of. Turned all my paperwork in, and within 2 days I was called saying I was approved. Esusu came in at the right time, a true life saver.”

Latoya R.

$23M

in funds disbursed to date. Over 12,000 families avoiding eviction

Rent Relief

“I began my journey with Esusu in April 2023 for rent relief program at my current housing complex, which was truly a God-send. Since then, my credit stability has improved tremendously with each on-time monthly payment and has increased my credit score and afforded me other opportunities to continue growing.”

Eugene H.

"Esusu Made Me Feel Like Part Of A Family"

Unlocking Better Credit

~200,000

Renters established their first-time credit scores through Esusu, a 45% increase from to 2023

Establishing credit opens doors to better housing, mortgages, and education opportunities.

Esusu renters saw an average credit score increase of 45 points

—a testament to what happens when we level the playing field

+36

point average increase in their credit scores in 2023

+45

point average increase in their credit scores in 2024

12%

of renters moved from sub-prime to prime

$50 Billion

In Credit Activity Unlocked—Doubling Up From 2023

.webp)

.webp)

Daphne H.

Renter

Eugene H.

Renter

Gina S.

Renter

Sharon S

Renter

Jennifer

Rent Relief Recipient

Shii V

Renter

Alexandria F

Renter

Natasha M

Renter

Brittney R.

Renter

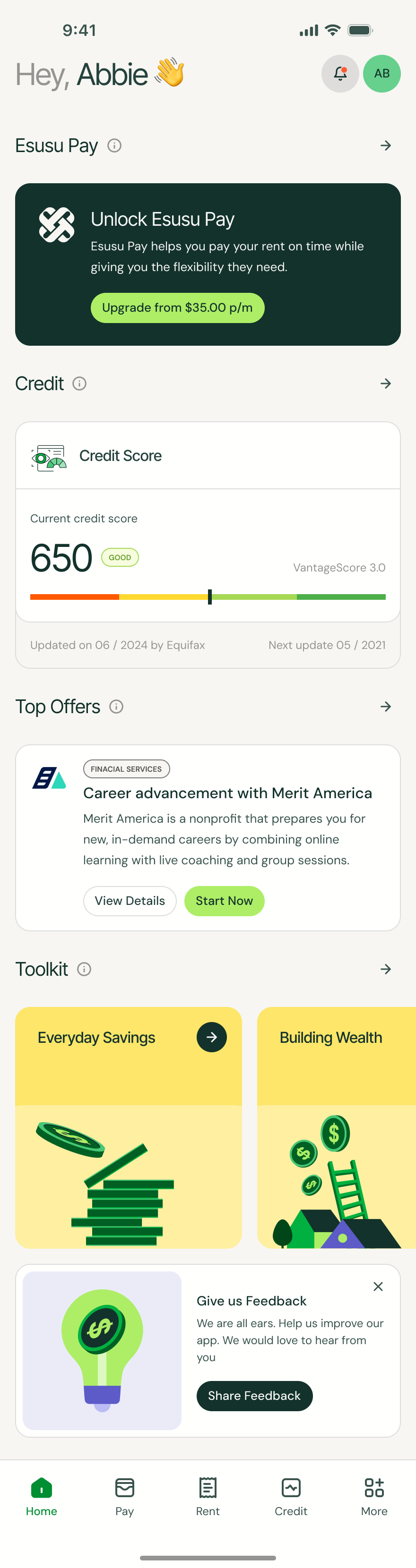

Inside Your Credit Hub Experience

myEsusu Mobile App

Esusu Dashboard

Renter Marketplace And Toolkit

.svg)

Ubuntu

Esusu Rebranded

.webp)

Industry Highlights

.svg)

.svg)

.svg)

Looking Toward 2025:

A letter from our founders

At Esusu, we embrace the principle of ‘Ever Evolving.’ This belief has guided us through a year of innovation and growth, positioning us to tackle the challenges ahead. As housing affordability and financial health take center stage nationally, we’ve witnessed the transformative power of providing people with tools to build stability and unlock opportunity—proving that when individuals thrive, entire communities flourish.

This underscores both the urgency of our mission and the responsibility we carry to uplift the communities we serve. We remain committed to adding value for our clients, championing human potential, and giving people the opportunity to succeed. The best days of Esusu are still ahead, and we are profoundly grateful for your support on this journey of impact and shared prosperity. Together, we will shape a brighter, more equitable future. Thank you for being with us every step of the way.

Forward together,

.svg)