Is your property using Esusu to help you build or raise your credit score? If so, welcome! You likely have some questions about who we are, what rent reporting is, and how to see the impact Esusu Rent Reporting can make on your credit score.

We’re here to answer these questions and help you understand credit reporting along the way.

A little about Esusu

We’re a financial technology company that partners with real estate companies around the country to enable renters to establish and build their credit through Esusu Rent Reporting.

We work directly with your property manager to report every on-time rent payment you make to the credit bureaus to impact your score positively. If your property is already using Esusu, you’ll be learning more about the process through our onboarding communications.

How do I check my credit score?

Once you’ve established a credit score, there are plenty of ways to check it. If you have a credit card, the provider may offer a tool that allows you to check your score for free. If you’ve taken out a loan, it may be on your loan statement from your lender.

The most accessible and accurate way to check your credit score, however, is by requesting your free annual credit reports. A credit report is a statement that shows your score, plus a record of your personal credit activity and current credit standing (including your on-time payment history, balance, open accounts, etc.). Checking your credit report helps you monitor your score, what is affecting it, and identify any possible fraud or mistakes.

You’re going to have more than one credit report, because there are three national credit bureaus: Equifax, Experian, and TransUnion. Everyone with a US credit score is entitled to a free, annual copy of their personal credit report from each of the three bureaus.

The Consumer Financial Protection Bureau recommends requesting a free copy of your credit report at AnnualCreditReport.com or by calling 877-322-8228.

If you want to check your report more frequently, visit Equifax, Experian, and TransUnion’s websites to see how.

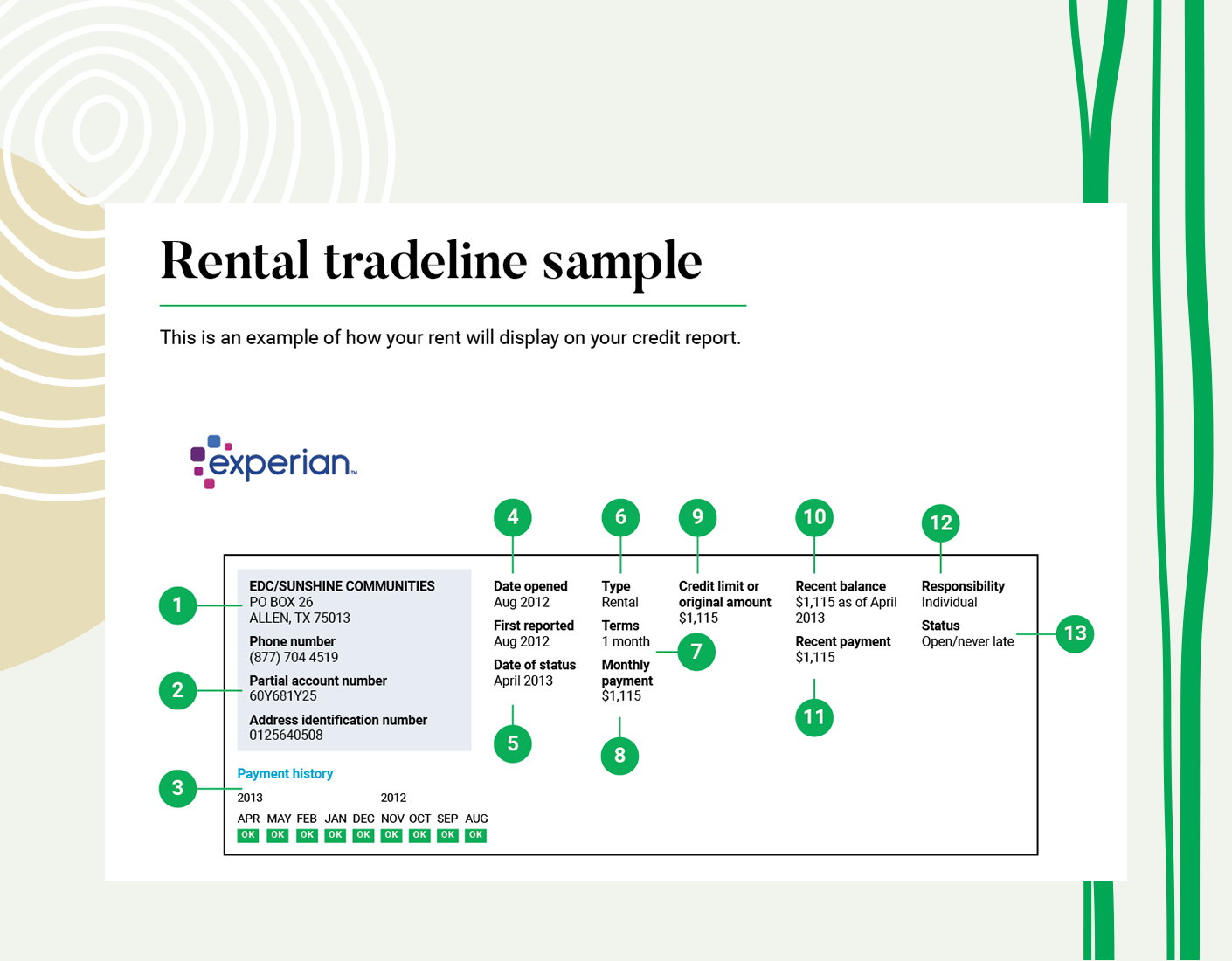

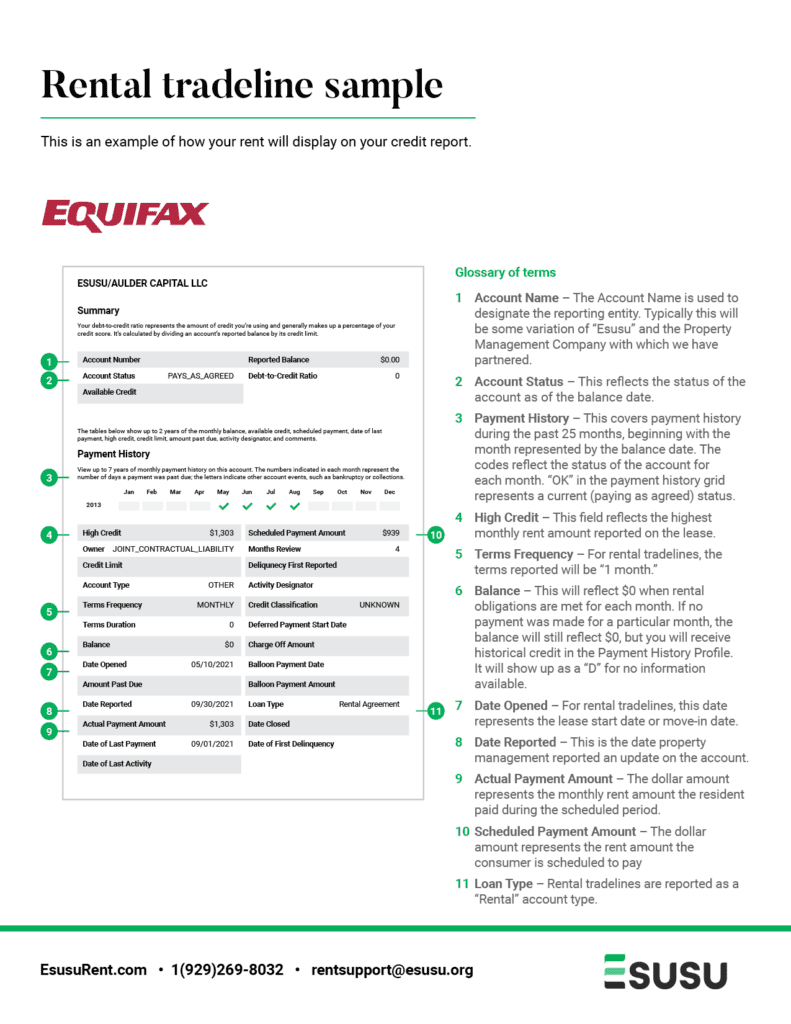

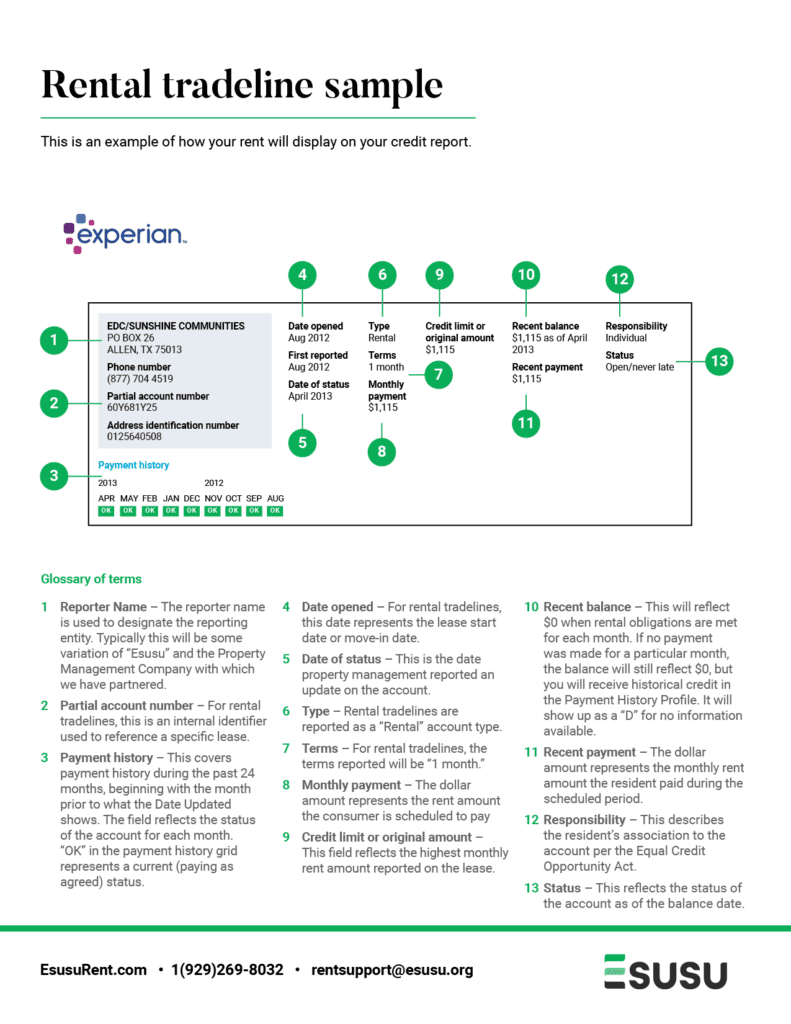

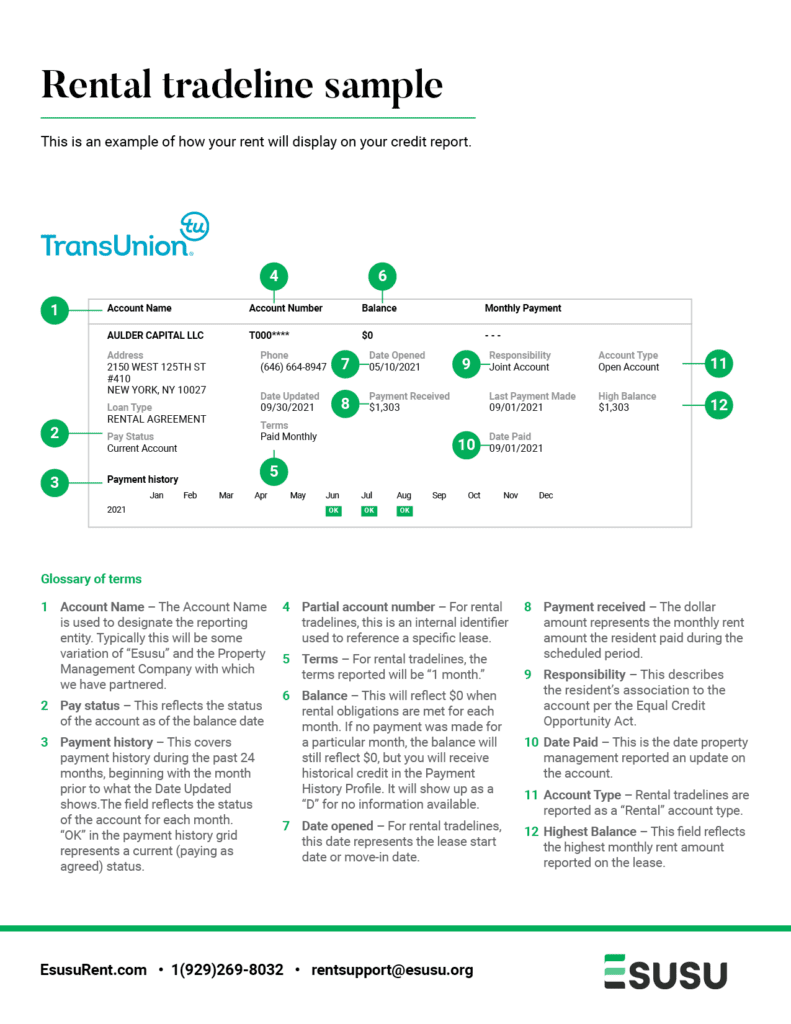

How Esusu Rent Reporting shows up on your credit report

The goal of Esusu Rent Reporting is to help you establish or build your credit score. We do that by reporting only on-time payments, and you can read more about how Esusu Rent Reporting affects your credit score on our blog.

Once you begin reporting your rent payments with Esusu, you’ll be able to see them on your credit report. Our naming conventions will show up a little differently on each bureau’s report. However, you will likely see “Esusu” and your property management company or the name of your property owner.

If you check your score on another credit reporting tool, you may see Esusu Rent Reporting show up as a “loan.” Don’t worry, if you see this. “Loan” is just the terminology the credit bureaus use to reflect your owed monthly rent per your lease agreement.

Want a closer look at what these credit reports might look like? You can download PDFs of sample credit reports below:

Credit Report Sample: Experian

Credit Report Sample: TransUnion

Have additional questions? We’re here to help!

Renters whose properties are currently using Esusu Rent Reporting should check their email for onboarding information. You can also call, text or email us at the information provided below with additional questions. Or check out our FAQs.

Phone: 1.929.269.8032

SMS: 1.646.941.7750

Email: rentsupport@esusu.org

Hours: 9am EST to 5pm EST

If you think your property is using Esusu Rent Reporting, but you haven’t received an email from us, reach out to your property manager directly.