Esusu, Inc. calls for additional research and evidence-based decision making in advancing positive rent reporting for renters, property owners, and property managers across the United States. Read our white paper or download the PDF version via the link below.

Executive Summary

This white paper explores the transformative impact of integrating rent reporting into credit profiles, emphasizing its role in improving credit scores and creating wealth-building opportunities. Esusu, Inc.’s strategic vision is to advocate for better access to the development of strong credit profiles through rent reporting. This approach ensures that rent reporting actively contributes to advancing housing affordability, a goal endorsed by Freddie Mac, Fannie Mae, and The Department of Housing and Urban Development (HUD), among others. As we navigate the evolving financial landscape, this paper highlights key studies, including those from HUD, and outlines Esusu’s commitment to collaborating with prominent institutions like the New York University Furman Center, the Consumer Financial Protection Bureau (CFPB), and other regulators. These collaborations aim to formulate consumer-friendly practices and policies that recognize and reward renters for paying their rent on time.

I. Introduction

Credit scores are fundamental indicators of financial trustworthiness. They shape the financial futures of the individuals who need stability most. Renters are seven times more likely than homeowners to lack a credit score, making it nearly impossible to get approved for a home mortgage, access first-time homeownership, and build wealth.(1) If and when on-time rental payment data is reported to the credit bureaus by a renter’s landlord or property manager, it becomes one of the few debt-free and interest-free ways to build credit in the United States. Recent research suggests that incorporating rent reporting into credit assessments holds the potential to bridge this historic credit gap, fostering financial inclusion and empowerment.

II. The Power of Rent Reporting

A. Key Findings

Rent reporting and rental payment history improve credit scores and homeownership access

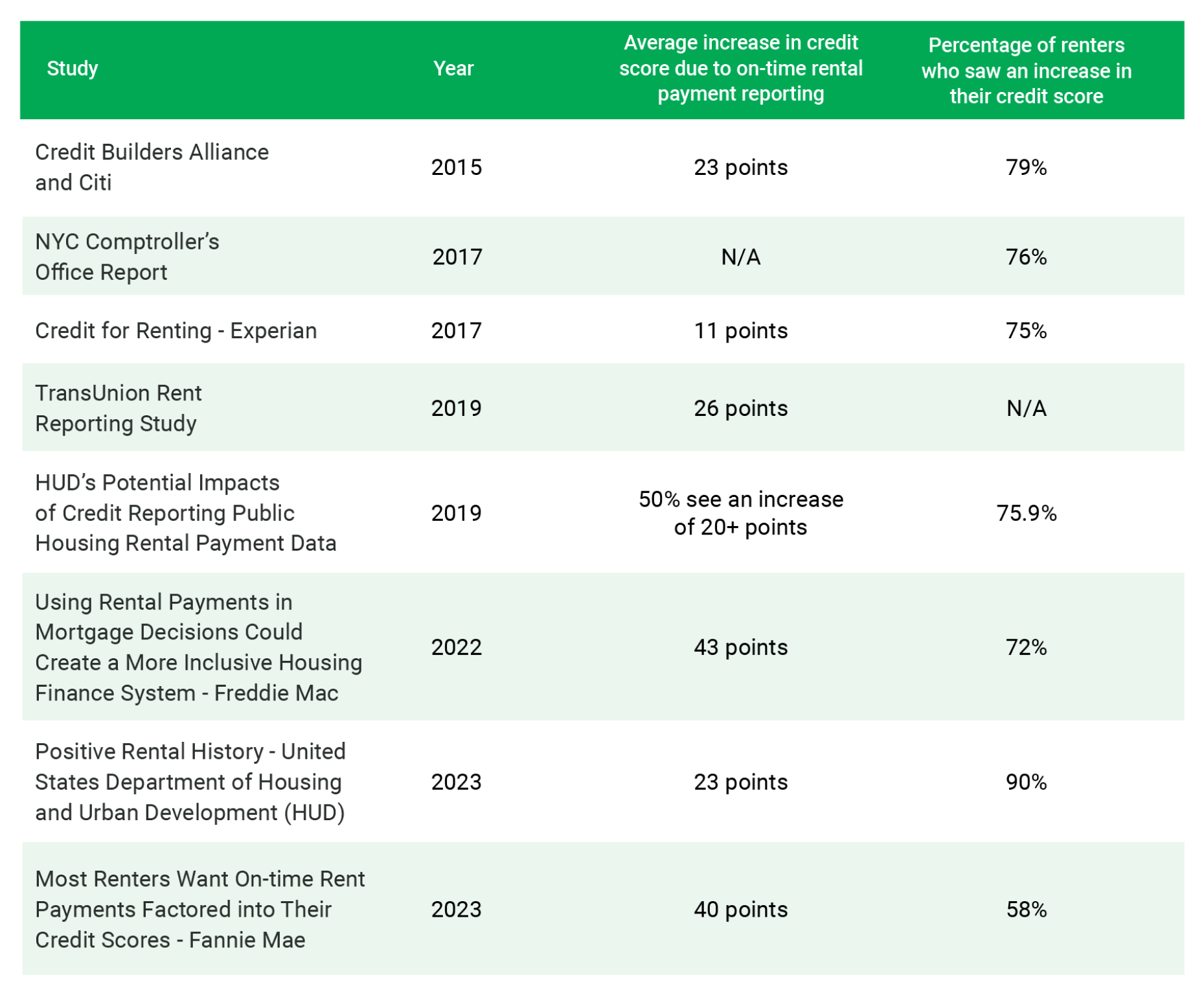

Positive-only rent reporting has been documented since 2015 as positively impacting the credit scores of participating renters. Table 1 shows the summarized studies that collectively underscore the positive correlation between rent reporting and credit score improvement, particularly benefiting those with limited credit history. Successful initiatives, as highlighted by the Credit Builders Alliance, Experian, TransUnion, the Department of Housing and Urban Development (HUD), New York City (NYC) Comptroller Office, and the Urban Institute, showcase the potential for increased credit scores and greater financial inclusion through rent reporting.

Table 1: Key Findings From Select Rent Reporting Studies (2)

Wenzhen Lin and Jeffrey Perry’s 2023 exploration of the potential impacts of rent reporting for HUD further emphasizes the significance of incorporating rental payment data.(3) The data reveals a positive correlation between reporting rental payment history and increased homeownership.

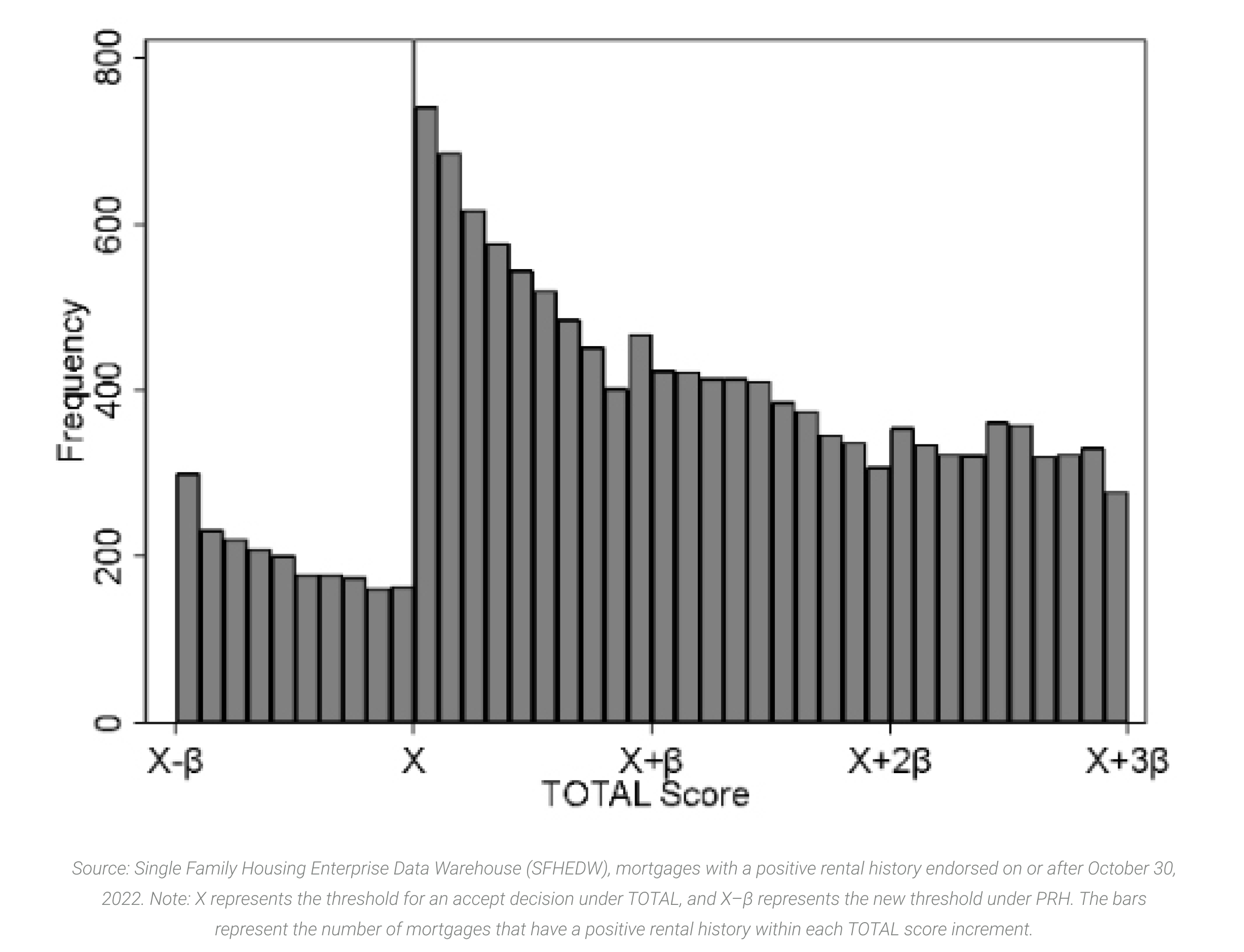

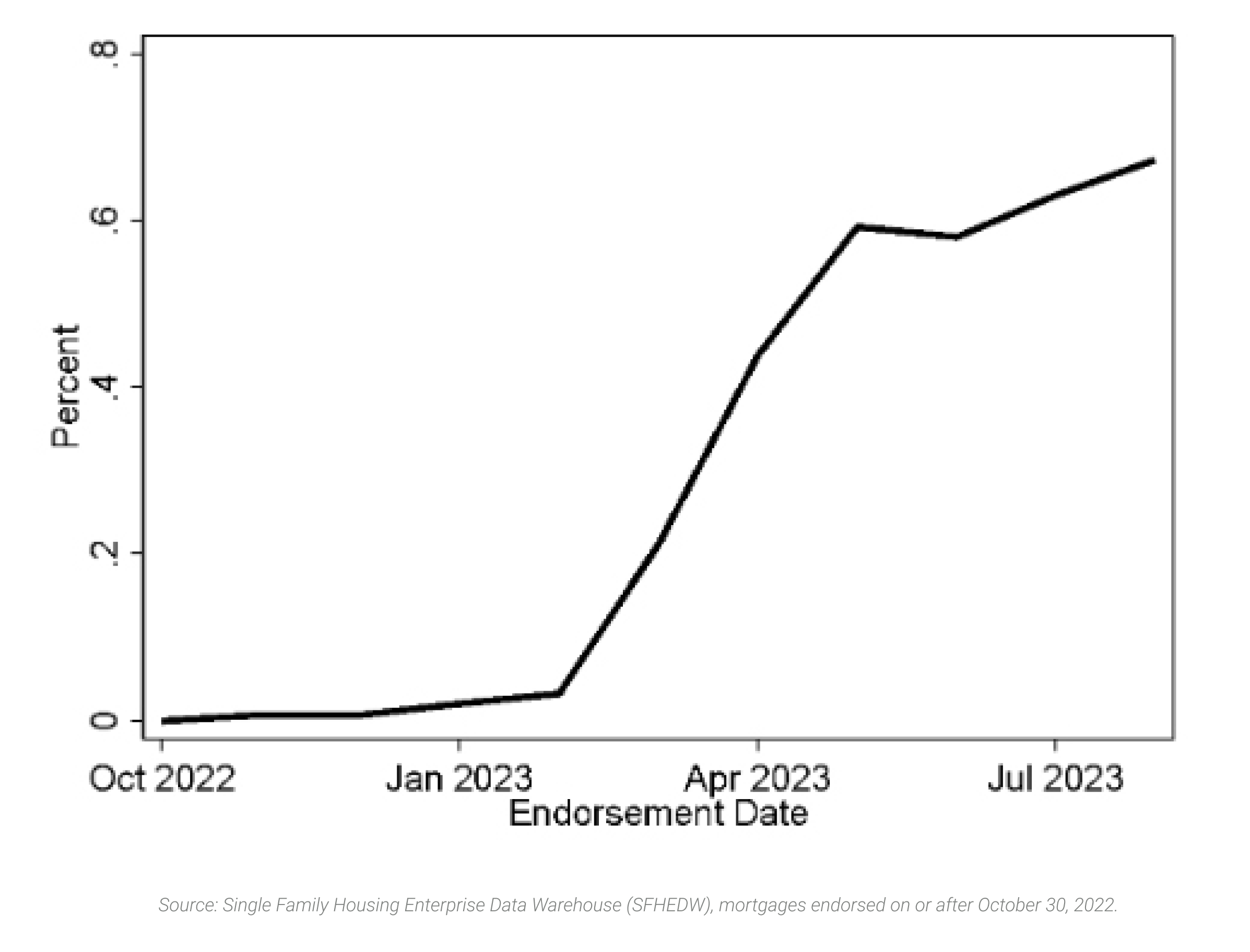

According to Lin and Perry’s research, starting from October 30, 2022, the Federal Housing Administration’s (FHA’s) Technology Open to Approved Lenders (TOTAL) began accepting mortgages that meet the Positive Rental History (PRH) criteria. However, the number of PRH endorsements was initially low until March 25, 2023, when lenders were required to report them. By August 31, 2023, a total of 1,727 endorsements got approval from TOTAL because of PRH. The endorsements falling between the PRH threshold X-β and the standard threshold X are fewer than those already above the threshold (refer to Figure 1). These PRH endorsements make up about 0.4 percent of all purchase loans since October 2022. The share of endorsements qualifying through PRH was approximately 0.2 percent in March 2023, rising to 0.7 percent by August 2023 (refer to Figure 2).

If this percentage stays steady at around 0.7 percent of purchase endorsements, PRH endorsements would constitute about 5,600 mortgages in a typical year of 800,000 purchase mortgage originations, totaling around $1.2 billion within a total volume of $175 billion.

Figure 1: Counts of Purchase Endorsements With Positive Rental History Near the Threshold, via United States Department of Housing and Urban Development, Office of Policy Development and Research

Figure 2: Share of Purchase Endorsements Accepted Through Positive Rental History, via United States Department of Housing and Urban Development, Office of Policy Development and Research

Further insight into the positive impacts of rent reporting

Esusu’s mission is to empower renters and contribute to financial inclusion through rent reporting and responsible data usage. For more than four years, Esusu has led the way in rent reporting, aligning and collaborating with consumer protection principles while promoting progress in the financial industry. By doing so, we have curated the largest data set on rent reporting outcomes in the United States.

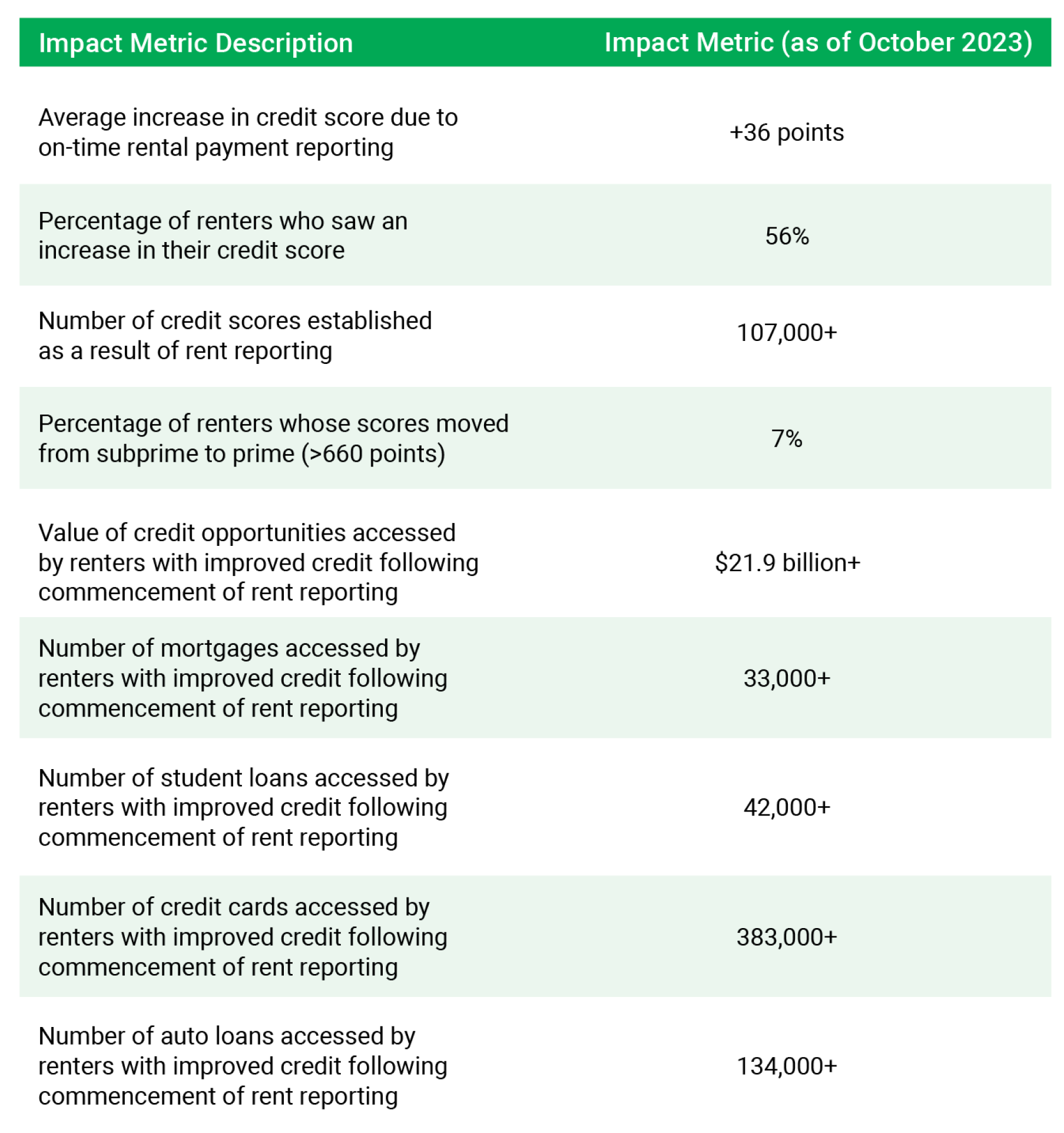

As of October 2023, Esusu has reported rental payment data for millions of American renters. Our data highlights that participating renters not only saw credit score improvements but also increased access to first-time credit scores and important financial tools.(4) Many renters have gone from living without a credit score to accessing student loans, credit cards, car loans, and mortgages. Table 2 highlights key impact metrics from Esusu’s portfolio as of October 2023.

Table 2: Esusu renter impact metrics, 2023

B. Fannie Mae and Freddie Mac Multifamily’s Support of Rent Reporting and Rental Payment History

Fannie Mae and Freddie Mac Multifamily have also played a crucial role in providing incentives to make rent reporting a standard in the industry. Through their collective positive-only rent reporting programs, they have supported nearly half a million renters in having their positive rental data reflected on their credit scores.(4) Fannie Mae and Freddie Mac’s recognition of the significance of rental payment history by including this data in mortgage underwriting signifies a shift toward a more holistic and inclusive approach to assessing creditworthiness and access to home buying.(5,6) The impact on homeownership is substantial, facilitating a smoother transition for individuals with a positive rental history to qualify for mortgages.

III. Call to Action

Despite the strides made in recognizing the impact of rent reporting, there is a crucial need for further research and widespread adoption. Esusu, Inc. calls upon regulatory bodies, including the Consumer Financial Protection Bureau (CFPB), the Department of Housing and Urban Development (HUD), and other stakeholders, to collaborate in promoting the integration of rent reporting into credit assessments on a broader scale.

IV. Esusu’s Commitment to Research

Esusu, Inc. is committed to conducting comprehensive research on the long-term impact of rent reporting on credit scores and wealth-building. By leveraging data and insights, Esusu aims to contribute to refining and expanding financial inclusion strategies and help every American who chooses the path of homeownership accomplish that dream.

V. Conclusion

Rent reporting has proven to be a powerful tool for leveling the playing field in credit assessments and facilitating wealth-building opportunities. As industry leaders recognize the importance of incorporating rental data into credit evaluations, Esusu emphasizes the need for continued advocacy for research, collaboration, and widespread adoption to ensure a more inclusive and equitable financial landscape. Esusu remains at the forefront of this initiative, working tirelessly towards a future where renters receive credit where credit is truly due.

Sources:

- Using Rental Payments in Mortgage Decisions Could Create a More Inclusive Housing Finance System | Urban Institute. (2022, April 6). Urban Institute. https://www.urban.org/urban-wire/using-rental-payments-mortgage-decisions-could-create-more-inclusive-housing-finance

-

Sources cited in Table 1:

- Credit Builders Alliance and Citi: https://www.creditbuildersalliance.org/wp-content/uploads/2019/06/CBA-Power-of-Rent-Reporting-Pilot-White-Paper.pdf

- NYC Comptroller’s Office Report: https://comptroller.nyc.gov/reports/making-rent-count/rent-and-credit-report/

- Credit for Renting – Experian: https://www.experian.com/content/dam/marketing/na/assets/im/rentbureau/white-papers/experian-rentbureau-credit-for-rent-analysis2.pdf

- TransUnion Rent Reporting Study: https://newsroom.transunion.com/rent-reporting-will-motivate-seven-in-10-renters-to-make-more-on-time-payments/

- HUD’s Potential Impacts of Credit Reporting Public Housing Rental Payment Data: https://www.huduser.gov/portal/sites/default/files/pdf/Potential-Impacts-of-Credit-Reporting.pdf

- Using Rental Payments in Mortgage Decisions Could Create a More Inclusive Housing Finance System – Freddie Mac: https://mf.freddiemac.com/docs/update_03112022.pdf

- Positive Rental History – United States Department of Housing and Urban Development (HUD): https://www.huduser.gov/portal/pdredge/pdr-edge-trending-120523.html#:~:text=Borrowers%20are%20considered%20to%20have%20PRH%20when%20they%20can%20demonstrate,The%20transaction%20is%20a%20purchase.

- Most Renters Want On-time Rent Payments Factored into Their Credit Scores – Fannie Mae: https://www.fanniemae.com/research-and-insights/perspectives/renter-on-time-payments-credit-scores

- Positive Rental History | United States Department of Housing and Urban Development, Office of Policy Development and Research. (2022, December 5). Www.huduser.gov. Retrieved January 9, 2024, from https://www.huduser.gov/portal/pdredge/pdr-edge-trending-120523.html#:~:text=Borrowers%20are%20considered%20to%20have%20PRH%20when%20they%20can%20demonstrate

- Esusu’s 2023 Year in Review. (2023). Esusu. Retrieved January 9, 2024, from https://esusurent.com/year-in-review/

- Qualify more homebuyers | Fannie Mae. (n.d.). Singlefamily.fanniemae.com. Retrieved January 9, 2024, from https://singlefamily.fanniemae.com/applications-technology/desktop-underwriter-desktop-originator/positive-rent-payments

- Freddie Mac Takes Further Action to Help Renters Achieve Homeownership | Freddie Mac. (2022). Freddie Mac. https://freddiemac.gcs-web.com/news-releases/news-release-details/freddie-mac-takes-further-action-help-renters-achieve