Pressed for time? Here’s a summary

While having a 600 credit score is not bad, we would not go as far as applying for loans. Especially for bigger purchases like a home. The best course of action would be to follow certain steps to improve your score over time.

While there aren’t any quick and easy ways to improve your score, starting off with a credit score of 600 is not the worst thing either.

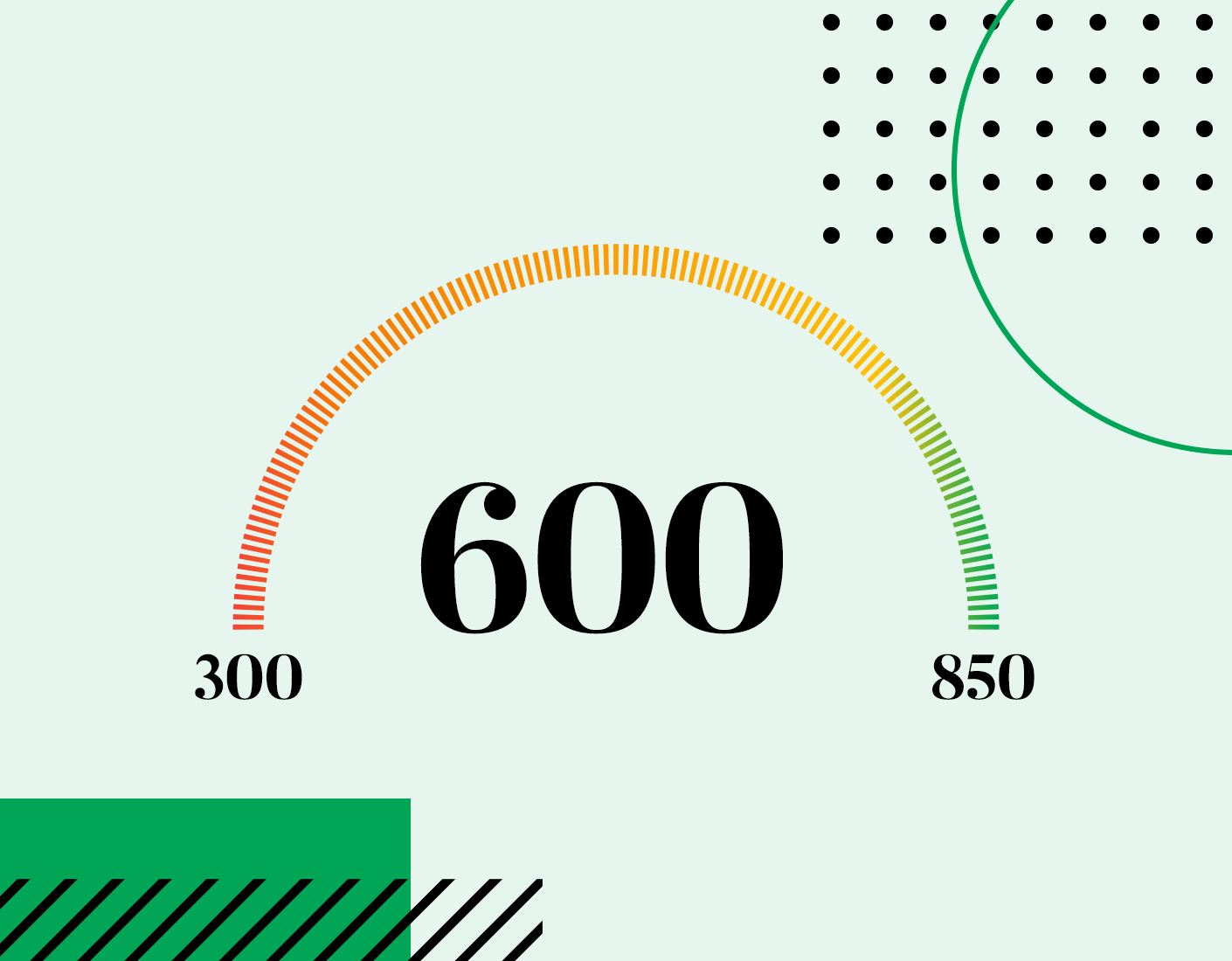

If you have a 600 credit score and want to know where you stand, here’s what you need to know.

A 600 credit score is considered a “fair” score. For a FICO score, that tends to be on the lower side. What does that mean for you? Well, lenders may see this as something not great and might disapprove of a loan you applied for. Should you be approved, you’ll likely be charged more interest for it.

What credit score do you need to be approved for loans easier?

This would be a great chance to say that credit scores are a complex thing. And while a credit score of 700 and above is considered good, lenders still have their way of judging you through your credit report.

It’s good to remember that aside from your credit score, lenders can see activity on your file, like bankruptcies that can last from 7 to 10 years in your credit report. Some credit cards even prevent you from getting approved if you’ve ditched cards after getting sign-up bonuses.

Needless to say, if you do need to get a loan, a 600 credit score might not be good to start with. Our recommendation? Build credit through other means like rent reporting. Getting loans with a 600 credit score will likely give you higher interest rates. It would be best to target somewhere in the range of 749-800 for ideal results.

What can you do if you have a 600 credit score?

If you have a 600 credit score and want to improve your credit for an upcoming big-ticket purchase, you’d probably want to find ways to increase that. Here are some common ways you can start.

Pay bills regularly

Putting this tip on the top of the list since this is by far the most basic and one of the most influential factors in your credit score. Trust us when we say that consistency in paying your bills over time is key if you want good results.

Check your credit report and dispute any inconsistent information

Some providers allow you to check your credit report and see all the things that play a role in your score. You should take this chance to see which areas you’ve lagged behind, like a couple of missed payments. It would also be the best time to check if there’s any inconsistent data on there like paid loans reported as unpaid or even late.

Keep your credit utilization in check

In general, keep the credit you use somewhere between 10 to 30 percent of your credit limit. That said, if your overall credit limit is at 100,000, the best use of your credit is to keep it below 30k and above 10k.

Leverage your rent for more credit

This is something that we encourage a lot of people to do. For people that pay rent, generally, that is the largest monthly bill that remains to this day, unreported to credit bureaus. Through companies like Esusu, you can report up to 2 years of payments. Just imagine reporting a year or 2 more after that eh?

Reasons why your 600 credit score can increase or decrease

We’ve talked about your credit score and what you can do to move on from that. Naturally, there are only 2 ways your credit score can go if it doesn’t stay where it is now.

If your credit score increases, it would be a good sign that could be caused by many things. One is that some past negative marks on your credit report have been removed (see how long derogatory remarks last in your credit report here). Aside from that, you may be building a better credit profile with on-time payments. Nevertheless, be consistent with your habits to keep your credit on the uptrend.

Now let’s look at the reasons why your score could drop.

A recent application for multiple accounts or loans

Some people trying to build credit will try to build their profile and open up multiple accounts and apply for loans. This gives the lenders permission to your credit report and warrants what we call ‘hard inquiries.’ Naturally, over the years, you will have hard inquiries on your credit report. But many of those in a short period can cause a bad mark.

Late or missed payments

Even for seasoned planners, it’s easy to miss some small details behind all the bustling schedules and life events. It would be wise to keep an updated list of your bills and mark your calendars for those due dates. Many apps could help you with that, and finding the one that fits you best is key.

Credit utilization increased

We’ve mentioned this in the past, but it’s good to repeat. If you do not know yet, some say that closing your unused accounts will help you build credit. That simply is not true, and it’s one key factor that increases your credit utilization higher than the recommended amount. That said, avoid closing your unused accounts and maintain your credit utilization from 10% to 30% of your total limit.

What to expect when building on your 600 credit score?

Like we’ve said, it shouldn’t take long to increase your credit if you have a good grasp of the fundamentals and build your credit only with good habits. Armed with that knowledge, if you see a gradual increase in your credit score, it would be best not to apply with every lender there is. Instead, continue building your credit and making your report emanate trustworthiness. That would be key in getting your big purchases and help you tick off that life goal of yours.

Wrapping up

Unfortunately, a 600 credit score will not get you far in terms of big-ticket purchases. We hope if you’ve reached this point, we’ve at least equipped you with the knowledge you need to achieve a better credit score.